Accounts Payable Google Sheets Template

Accounts Receivable Tracker for Google Sheets. Monitor vendor invoices and payments. No more overdue bills! Ready spreadsheet. Printable account statement.

Accounts Payable Tracker in Google Sheets

Manage your vendor payments with Accounts Payable Tracker Google Sheets Template. Designed for small businesses, bookkeepers, and accounting professionals who need to track vendor invoices, monitor payment deadlines, and maintain organized financial records.

![]()

This AP tracker eliminates manual calculations and reduces the risk of late payments. Enter invoice details once, and the template automatically calculates due dates, and outstanding balances. Pre-built formulas and conditional formatting keep your payables organized without complex accounting software.

What’s Included in the Accounts Payable Template?

This Google Sheets accounts payable tracker includes:

- Invoice Management Dashboard

- Vendor information fields (name, contact, payment terms)

- Invoice number and date tracking

- Line-item entry for multiple invoices per vendor

- Due date calculations based on payment terms

- Printable Account Statement form

- Dashboard summary

How to use Accounts Payable Google Sheets Tracker?

The template consists of five main parts:

- Menu

- Suppliers

- Accounts Payable Ledger

- Accounts Statement

- Dashboard

![]()

1. Menu

Firstly, start from the menu section. You have a settings part in addition to navigation buttons.

![]()

On the Settings section, please list your supplier groups or categories. Then, set the day number of “approaching invoice warning” beforehand a due date.

Now, with the navigation buttons you can deep dive into the Accounts Payable Tracker Google Sheets Template.

2. Supplier list

In this section, you will list your suppliers or vendors with relevant information such as Telephone, Address, Contact Person, Bank Details, etc.

![]()

This list will be used as a dropdown menu in the next section

3. Accounts Payable Ledger

This is the main recording section of the template. You’ll record your invoices and payments here.

So, firstly you’ll add your invoices in the list:

![]()

Select the supplier, then add the Invoice No and Date, also set the Invoice Due Date and Amount.

Then, you can record the payments at the same row:

![]()

Also, you can enter partial payments here. Record you payment date and paid amount. The template will calculate the Balance Due and show you the Status of the Invoice.

Lastly, on the Accounts Payable Ledger sheet, you have filters to narrow down your analysis. You can select more than one options at any time.

4. Account Statement

Mostly, you will need account statement to send your verndors to confirm if you’re aligned about the current balance.

So, this template provides you with ready statements. All you have to do is select the supplier from the dropdown list. All the transactions will be combined with calculated balance.

![]()

This is a printable and customizable Account Statement. You can change the logo and color palette according to your business.

5. Dashboard

Finally, you’ll have a Dashboard to analyze all the vendor payments. The Summary section will show you:

- Invoice number

- Invoice total

- Payment Total

- And Net Credit

![]()

Also, with professional charts, you can analyze monthly Invoice and Payment totals, Category Distribution, and also Invoice Status.

That’s all!

Whether you’re processing 10 invoices per month or managing hundreds of vendor relationships, this Accounts Payable Google Sheets Template scales with your business. Cloud-based access means your team can update payment status from anywhere, while built-in filters help you prioritize which bills to pay first.

Key Features and Benefits

- Automated Calculations: All formulas are pre-configured. The template calculates totals, aging periods, and outstanding balances automatically when you enter invoice data.

- Conditional Formatting: Overdue invoices highlight in red. Upcoming due dates show in blue. Visual cues help you prioritize payments at a glance.

- Data Validation: Dropdown menus ensure consistent data entry across payment status, vendor names, and payment methods. Reduces errors and makes reporting accurate.

- Cloud-Based Access: Access your AP data from any device with internet connection. Multiple team members can view or edit simultaneously with proper permission settings.

- No Software Installation: Works entirely in Google Sheets. No downloads, installations, or subscription fees for additional software. Just a free Google account.

- Scalable Design: Start with a few vendors and scale to hundreds. The template structure handles growing transaction volumes without performance issues.

Who Should Use This Template?

Small Business Owners

Track all vendor bills in one place. Never miss a payment deadline or lose an invoice again. Keep accounts payable organized without hiring a full-time bookkeeper.

Bookkeepers and Accountants

Manage client accounts payable efficiently. Provide clients with clear reports on outstanding obligations. Streamline month-end closing processes.

Startups and Entrepreneurs

Control cash flow with visibility into upcoming payment obligations. Make informed decisions about when to pay vendors based on available funds.

Finance Teams

Coordinate payment approvals across departments. Maintain audit trails for all vendor payments. Generate reports for management review.

Freelancers with Contractors

Track payments owed to subcontractors and service providers. Ensure timely payments to maintain good working relationships.

Technical Points:

Platform: Google Sheets

File Type: Shareable link (make unlimited copies)

Compatibility: Works on desktop, tablet, and mobile devices

Requirements: Free Google account, internet browser

Formulas: Pre-built using standard Google Sheets functions

Macros/Scripts: None (pure spreadsheet formulas)

Collaboration: Supports multiple users with permission controls

Export Options: Download as Excel (.xlsx) or PDF

Common Use Cases for Accounts Payable Template

- Managing Recurring Vendor Bills

Set up recurring vendors with standard payment terms. Quickly log monthly invoices and track payment patterns over time.

- Avoiding Late Payment Fees

The aging report highlights upcoming due dates. Schedule payments in advance to avoid penalties and maintain good vendor relationships.

- Month-End Closing

Generate reports showing all unpaid invoices as of month-end. Reconcile accounts payable balances for financial statements.

- Cash Flow Planning

View all upcoming payment obligations by due date. Plan cash requirements based on when bills need to be paid.

- Vendor Performance Analysis

Track total spending per vendor. Identify your largest suppliers and analyze spending patterns for better negotiation leverage.

- Audit Preparation

Maintain complete records of all invoices and payments. Search by invoice number, vendor, or date range during audits.

Frequently Asked Questions (FAQs)

- Can I use this Accounts Payable Google Sheets Template with Excel?

Yes, you can export to Excel format. Some formatting may need minor adjustments, but all formulas work in Excel.

- How many invoices can it handle?

The template efficiently manages thousands of invoice entries. Performance remains fast even with large data sets.

- Can multiple people access it simultaneously?

Yes, Google Sheets supports real-time collaboration. Set different permission levels for team members.

- Do I need accounting knowledge?

Basic understanding of accounts payable helps, but the template is designed for users without formal accounting training.

- Is customer support included?

Yes, email support is provided for setup questions and troubleshooting.

- Can I customize the Accounts Payable template?

Absolutely. Add custom fields, modify formulas, or adjust the layout to fit your specific requirements.

- Is training included?

Step-by-step instructions are provided within the template. Field definitions explain what information to enter in each column.

![]()

Knowledge Support On Accounts Payables

Here are some most asked questions about Accounts Payable terminology.

What is Accounts Payable?

Accounts payable (AP) is the money your business owes to vendors and suppliers for goods or services purchased on credit. When you receive an invoice but haven’t paid it yet, that amount sits in your accounts payable until payment is made. AP appears as a current liability on your balance sheet because it represents a short-term debt obligation.

What is the Accounts Payable Process?

The accounts payable process includes several steps:

- Purchase Order Creation – Your business orders goods or services from a vendor

- Goods/Services Receipt – You receive the products or services ordered

- Invoice Receipt – The vendor sends an invoice for payment

- Invoice Verification – You match the invoice against the purchase order and receipt

- Invoice Approval – Authorized personnel approve the invoice for payment

- Payment Processing – You issue payment via check, ACH, wire transfer, or credit card

- Record Keeping – The transaction is recorded in your accounting system

What is the Difference Between Accounts Payable and Accounts Receivable?

Accounts payable is money you owe to others. Accounts receivable is money others owe to you.

AP represents your company’s obligations to pay suppliers and vendors. It’s a liability on your balance sheet. AR represents amounts customers owe you for products or services you’ve delivered. It’s an asset on your balance sheet.

Think of it this way: when you buy inventory on credit, that’s AP. When you sell products to customers on credit, that’s AR.

What is an Accounts Payable Clerk?

An accounts payable clerk processes and manages vendor invoices and payments. Their responsibilities include:

- Reviewing and verifying incoming invoices

- Matching invoices to purchase orders and receipts

- Entering invoice data into the accounting system

- Scheduling payments based on due dates and cash flow

- Processing payments to vendors

- Maintaining vendor records and contact information

- Reconciling accounts payable statements

- Responding to vendor payment inquiries

- Preparing AP aging reports for management

What is Accounts Payable Turnover?

Accounts payable turnover is a financial ratio that measures how quickly a company pays its suppliers. It’s calculated by dividing total supplier purchases by average accounts payable during a period.

Formula:

A higher ratio indicates faster payment to vendors. A lower ratio suggests the company is taking longer to pay bills. This metric helps assess cash management efficiency and supplier relationship health.

What is an Accounts Payable Aging Report?

An AP aging report categorizes unpaid invoices by how long they’ve been outstanding. Standard categories are:

- Current – Invoices not yet due

- 1-30 days – Invoices 1-30 days past due date

- 31-60 days – Invoices 31-60 days past due

- 61-90 days – Invoices 61-90 days past due

- 90+ days – Invoices over 90 days past due

This report helps you prioritize which bills to pay first, identify cash flow issues, and maintain good vendor relationships by avoiding excessive delays.

What Are Accounts Payable Tracker Terms?

Accounts payable terms specify when payment is due and any discounts available for early payment. Common terms include:

- Net 30 – Payment due within 30 days of invoice date

- Net 60 – Payment due within 60 days

- 2/10 Net 30 – 2% discount if paid within 10 days, otherwise full amount due in 30 days

- Due on Receipt – Payment expected immediately upon receiving invoice

- EOM (End of Month) – Payment due at the end of the month

- COD (Cash on Delivery) – Payment required when goods are delivered

Understanding these terms helps you manage cash flow and take advantage of early payment discounts.

What is Three-Way Matching in Accounts Payable?

Three-way matching is a verification process that compares three documents before approving payment:

- Purchase Order – What you ordered

- Receiving Report – What you actually received

- Vendor Invoice – What the vendor is billing you for

All three documents must match in terms of quantities, prices, and descriptions. This process prevents overpayments, duplicate payments, and fraud. It ensures you only pay for goods and services you actually ordered and received.

What is Accounts Payable Automation?

Accounts payable automation uses software to streamline the invoice processing workflow. Automated systems can:

- Extract data from invoices using OCR technology

- Route invoices for approval electronically

- Match invoices to purchase orders automatically

- Flag exceptions and discrepancies

- Schedule payments based on due dates

- Generate electronic payments

- Create reports and analytics

Automation reduces manual data entry, speeds up processing times, minimizes errors, and provides better visibility into cash obligations.

What is the Difference Between Accounts Payable and Expenses?

Accounts payable is a liability account representing amounts owed to vendors. Expenses are costs incurred in operating your business.

When you receive an invoice, you record it as accounts payable (liability) and an expense (income statement). When you pay the invoice, accounts payable decreases and cash decreases, but the expense has already been recorded.

What Documents Are Needed for Accounts Payable?

Essential AP documents in a Accounts Payable Tracker include:

- Vendor Invoices – Bills requesting payment

- Purchase Orders – Your authorization to buy goods/services

- Receiving Reports – Confirmation of goods/services received

- Vendor Contracts – Terms and conditions of vendor relationships

- Payment Records – Checks, wire transfers, ACH confirmations

- Credit Memos – Adjustments or returns from vendors

- Vendor Statements – Monthly summaries from suppliers

- W-9 Forms – Vendor tax information for 1099 reporting

What is Accounts Payable Management?

Accounts payable management encompasses all processes and controls for handling vendor invoices and payments efficiently. Good AP management includes:

- Establishing clear approval workflows

- Negotiating favorable payment terms with vendors

- Taking advantage of early payment discounts

- Maintaining accurate vendor records

- Preventing duplicate payments and fraud

- Optimizing cash flow timing

- Building strong vendor relationships

- Ensuring compliance with tax regulations

- Generating reports for decision-making

Effective AP management improves cash flow, reduces costs, and strengthens supplier partnerships.

What Software Do You Use for Accounts Payable?

Common accounts payable software options include:

- QuickBooks – Popular for small businesses

- Xero – Cloud-based accounting platform

- NetSuite – Enterprise resource planning system

- Bill.com – Dedicated AP automation platform

- SAP – Large enterprise solution

- FreshBooks – Designed for service businesses

- Zoho Books – Affordable cloud accounting

- Google Sheets Templates – Spreadsheet-based tracking for startups and small businesses

The right choice depends on your business size, budget, and complexity of AP processes.

What Happens if You Don’t Pay Accounts Payable?

Failing to pay accounts payable on time can result in:

- Late payment fees and interest charges

- Damaged credit rating for your business

- Strained relationships with suppliers

- Loss of early payment discounts

- Suppliers requiring prepayment or COD terms

- Disruption to your supply chain

- Legal action from vendors

- Difficulty obtaining credit in the future

- Damaged business reputation

Maintaining timely payments is critical for operational continuity and business credibility.

What is Accounts Payable Reconciliation?

AP reconciliation is the process of comparing your internal AP records against vendor statements to ensure accuracy. Steps include:

- Obtain vendor statements for the period

- Compare statement balances to your AP ledger and Accounts Payable Tracker

- Identify and investigate discrepancies

- Verify all invoices and payments are recorded

- Check for missing invoices or unrecorded credits

- Adjust your records as needed

- Document any differences and resolutions

Regular reconciliation catches errors, prevents duplicate payments, and ensures your financial records accurately reflect obligations.

What Skills Are Needed for Accounts Payable?

Key skills for AP professionals include:

Attention to Detail – Accuracy is critical when processing invoices and payments

Numerical Aptitude – Comfortable working with numbers and calculations

Organization – Managing multiple vendors and deadlines simultaneously

Software Proficiency – Knowledge of accounting systems and spreadsheets

Communication – Interacting with vendors and internal stakeholders

Problem-Solving – Resolving invoice discrepancies and payment issues

Time Management – Prioritizing tasks to meet payment deadlines

Integrity – Handling financial transactions ethically

Basic Accounting Knowledge – Understanding debits, credits, and financial statements

Do you need help for your Excel files?

Let our Experts create custom files for you!

You may be also interested in:

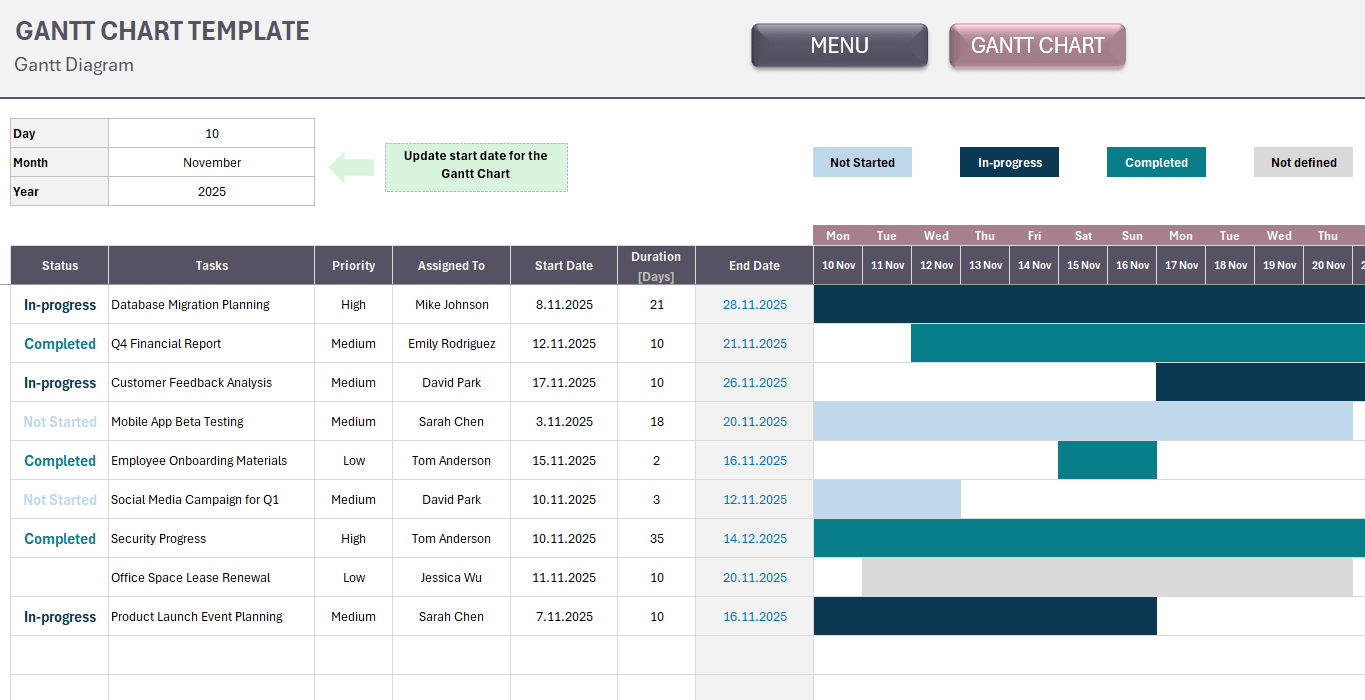

Gantt Chart Excel Template

Gantt Chart Excel Template. Simple task management tool. List your tasks and monitor entire project in a timeline. Editable Excel spreadsheet.

Accounts Payable Google Sheets Template

Accounts Receivable Tracker for Google Sheets. Monitor vendor invoices and payments. No more overdue bills! Ready spreadsheet. Printable account statement.

Accounts Receivable Google Sheets Template

Accounts Receivable Google Sheets Template. Record your invoices and payments, then track cash flow and open balances. Accounts Receivable Tracker. Ready file.

Birthday Tracker Google Sheets Template

Download Birthday Tracker Google Sheets Template. Keep track of all important dates throughout year. Gift planner and anniversary organizer.

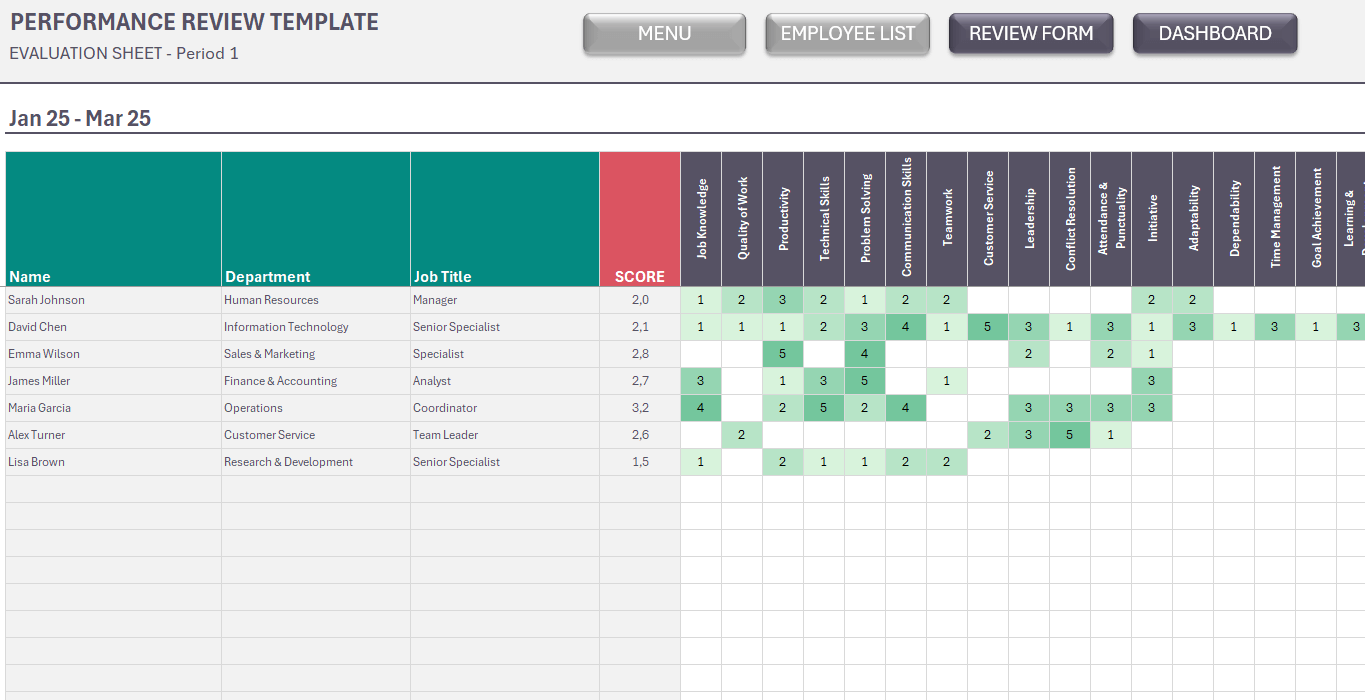

Employee Performance Review Excel Template

Download Employee Performance Review Excel Template. Rate your team members and analyze performance trend. Monthly, Quarterly, Semi-Annualy, or Yearly.

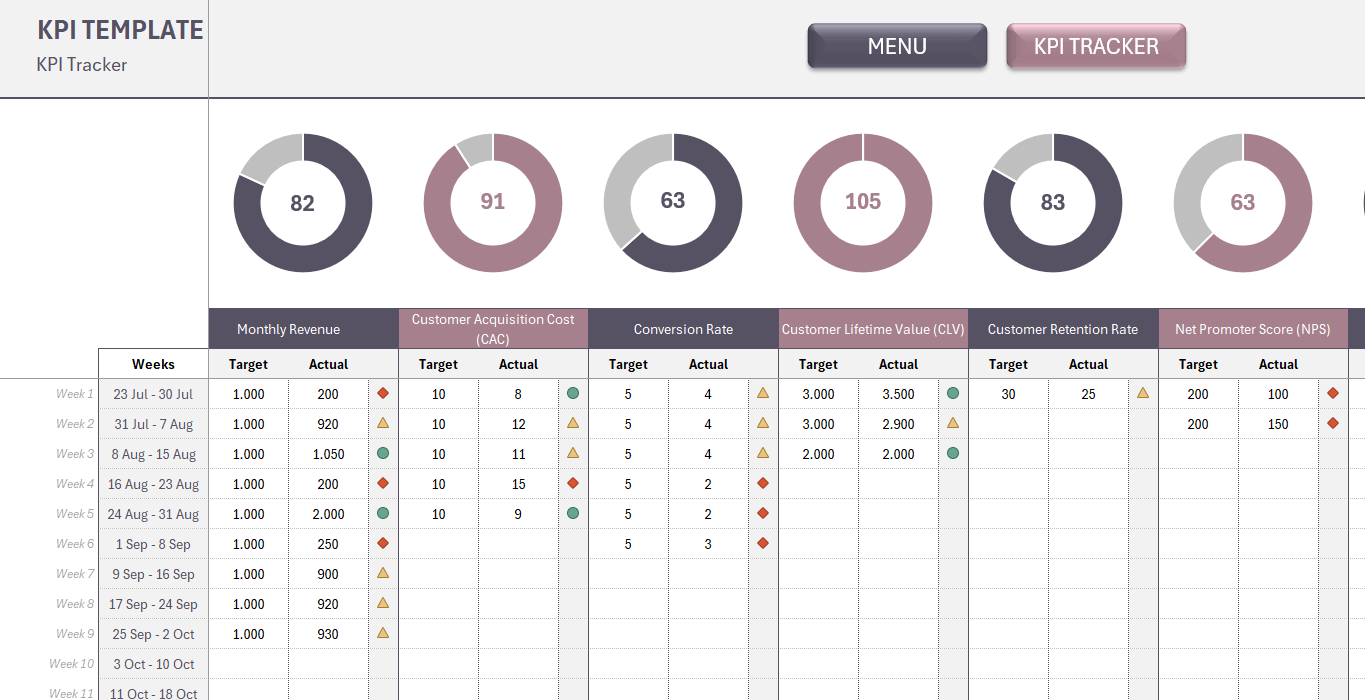

KPI Excel Template

Weekly KPI Tracker Spreadsheet. Instant download Excel file. Compare targets and actual numbers. Sleek-design KPI Dashboard. Download KPI Excel Template.