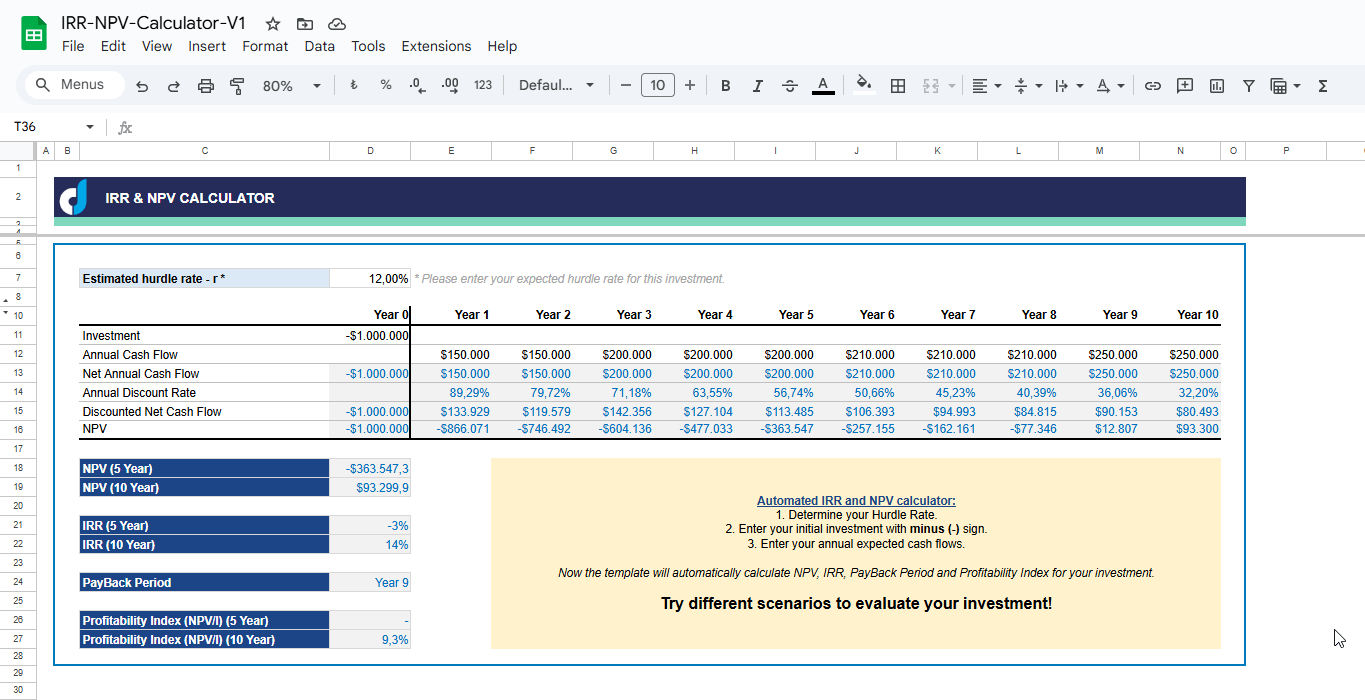

IRR and NPV Calculator Google Sheets Template

Ready-to-use investment evaluation tool. Google Sheets template to try different investment scenarios. Calculate IRR, NPV, PI and payback period.

Investment Analysis Spreadsheet: IRR & NPV Calculator

This is a Google Sheets file to calculate IRR and NPV easily. Instant download IRR NPV Calculator Spreadsheet to assess your investment scenarios.

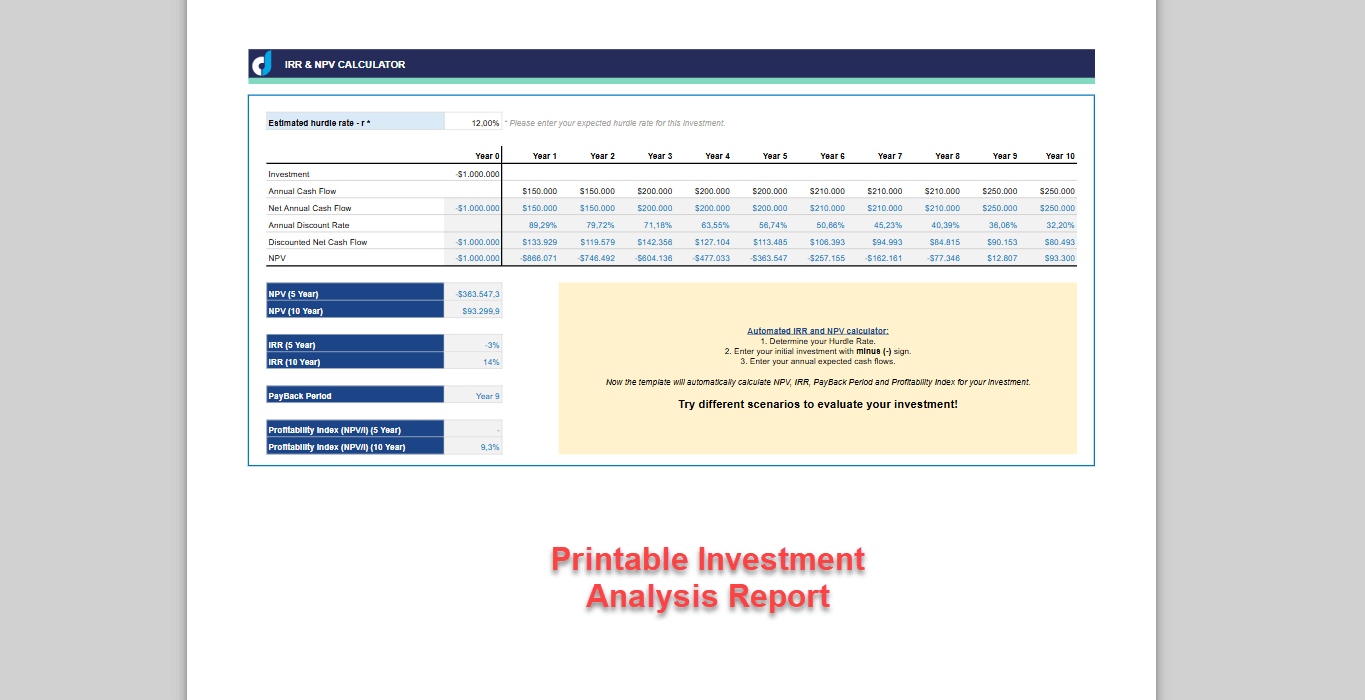

- Editable

- Printable

- Easy-to-use

- Google Sheets [You can download your file in Excel: File > Download > Excel]

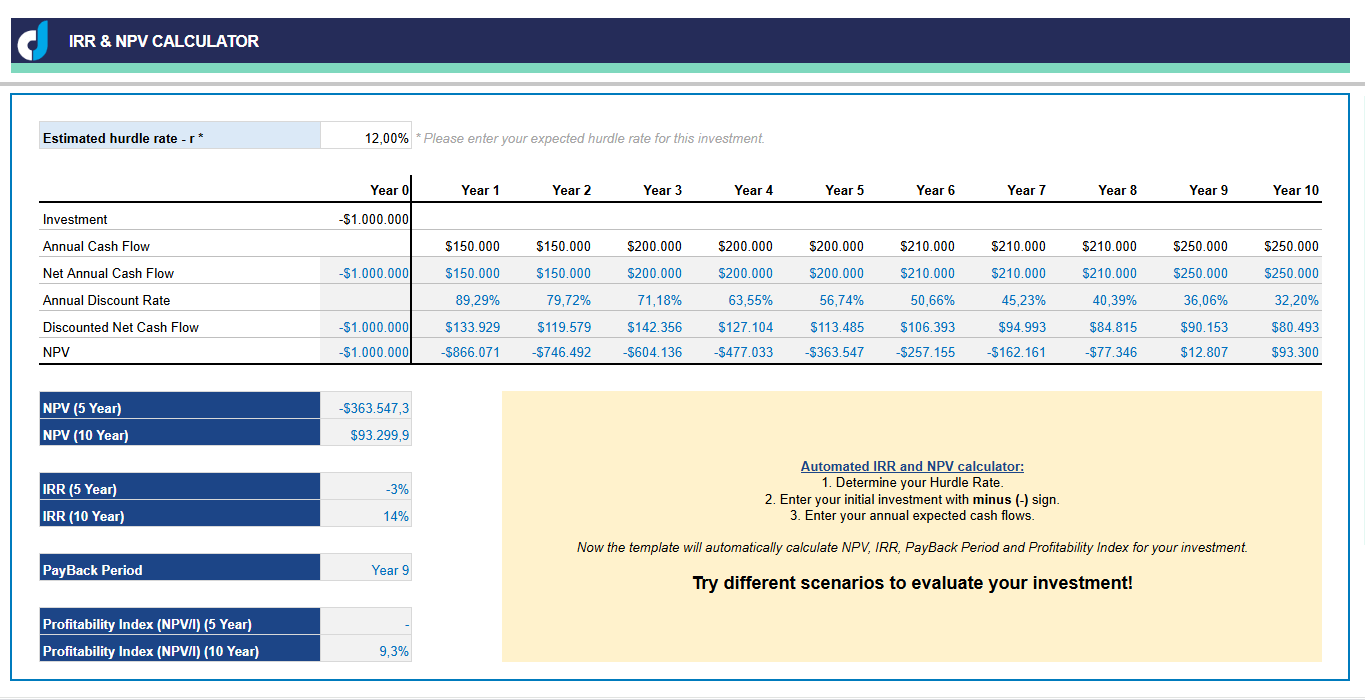

Make Smarter Investment Decisions with Confidence

Our comprehensive Investment Analysis Calculator template for Google Sheets transforms complex financial calculations into simple, actionable insights. Whether you’re a seasoned financial analyst or a business owner evaluating opportunities, this powerful yet user-friendly tool delivers the metrics you need to make informed investment decisions.

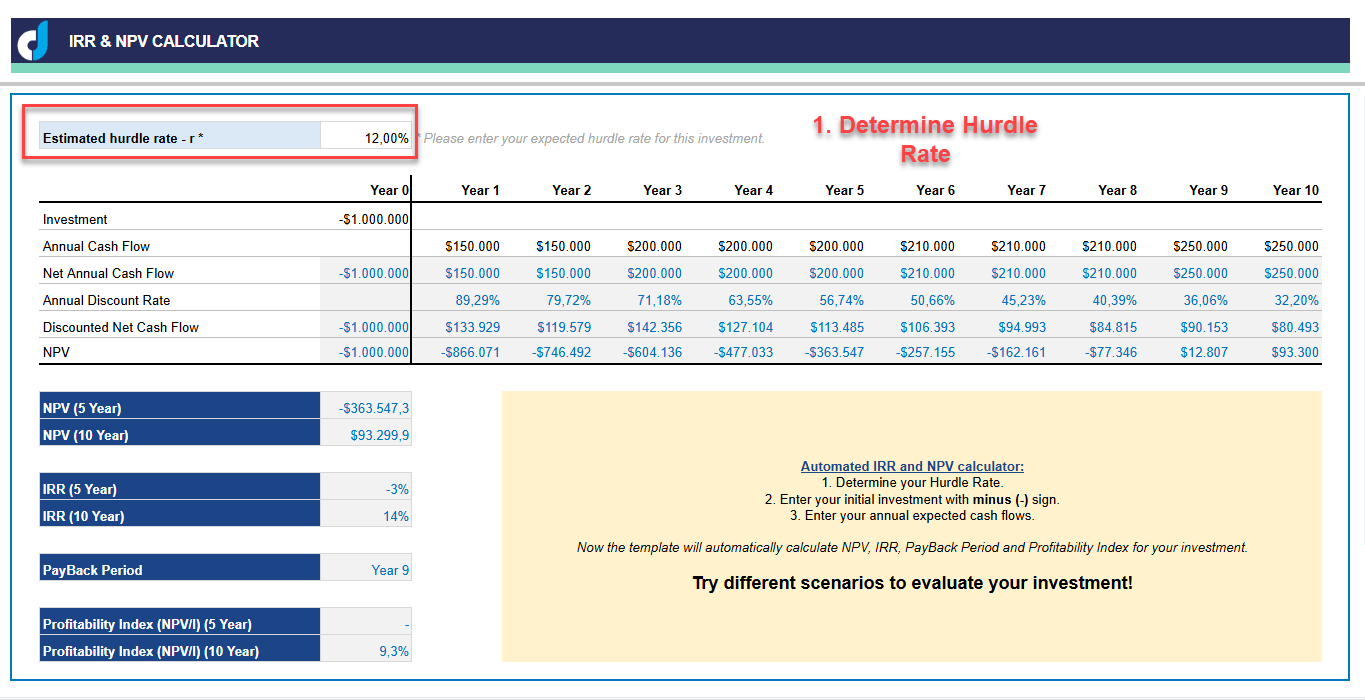

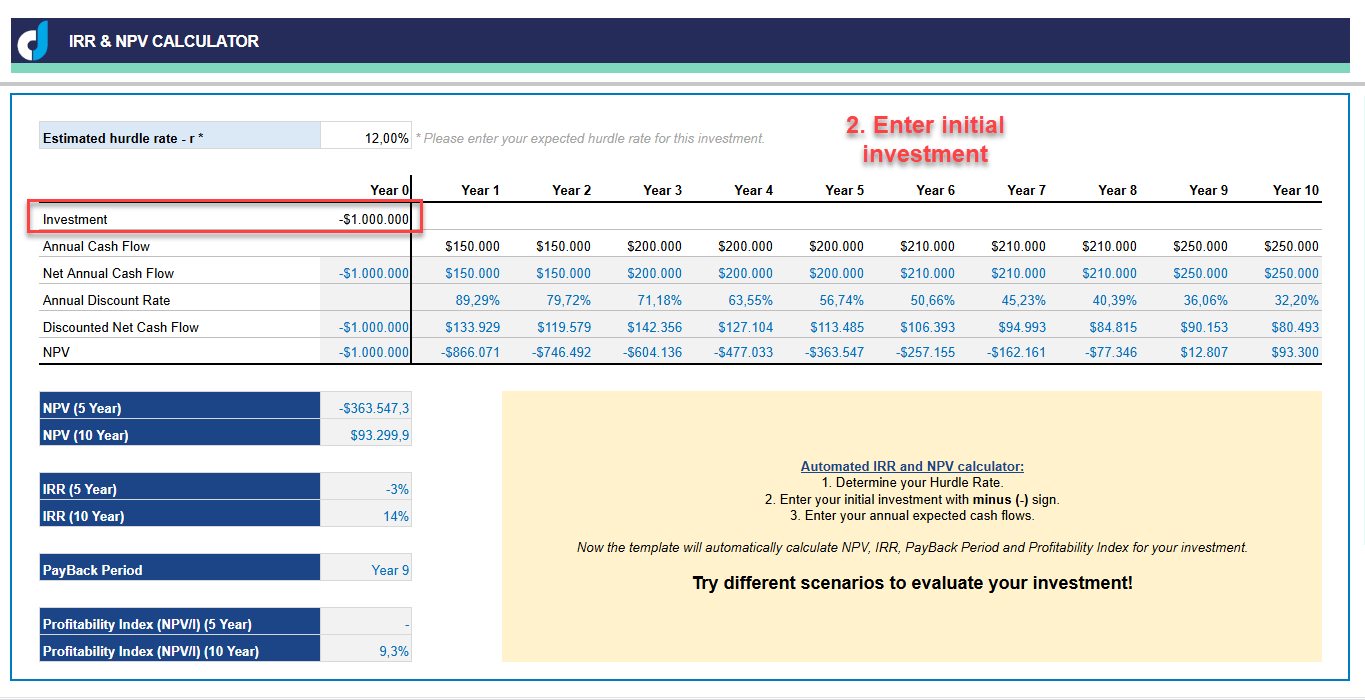

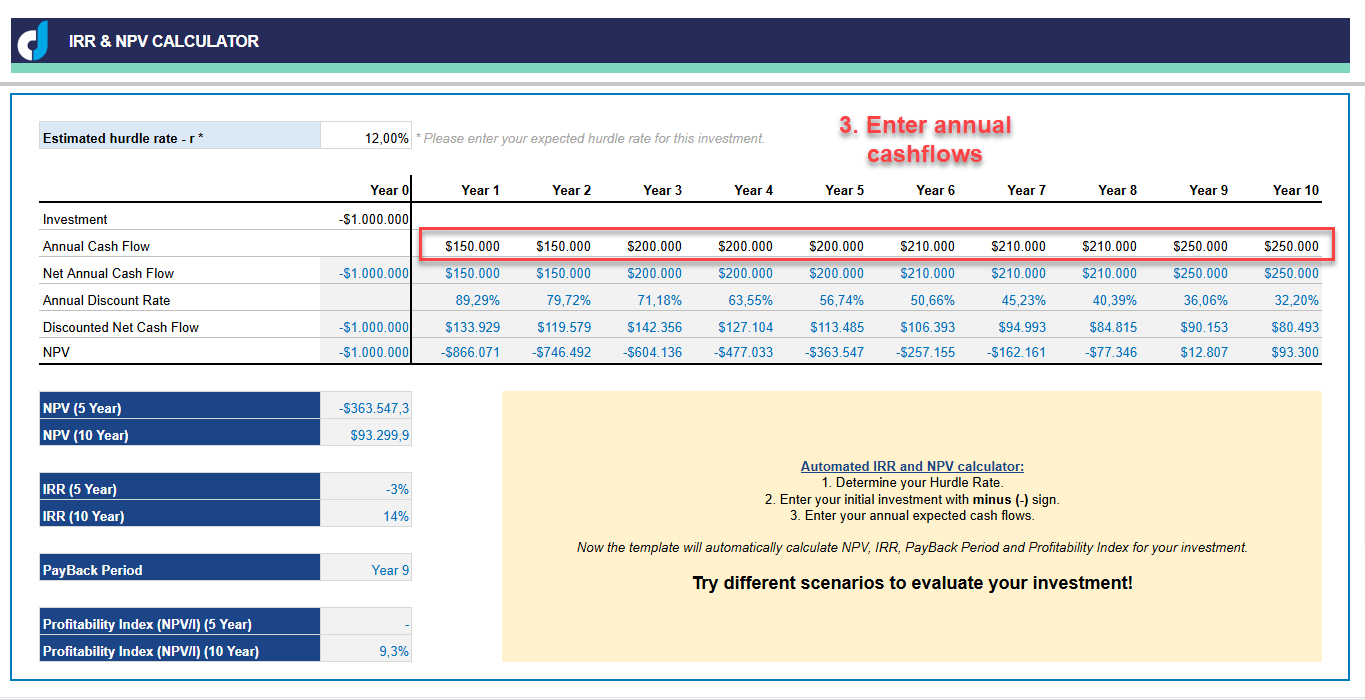

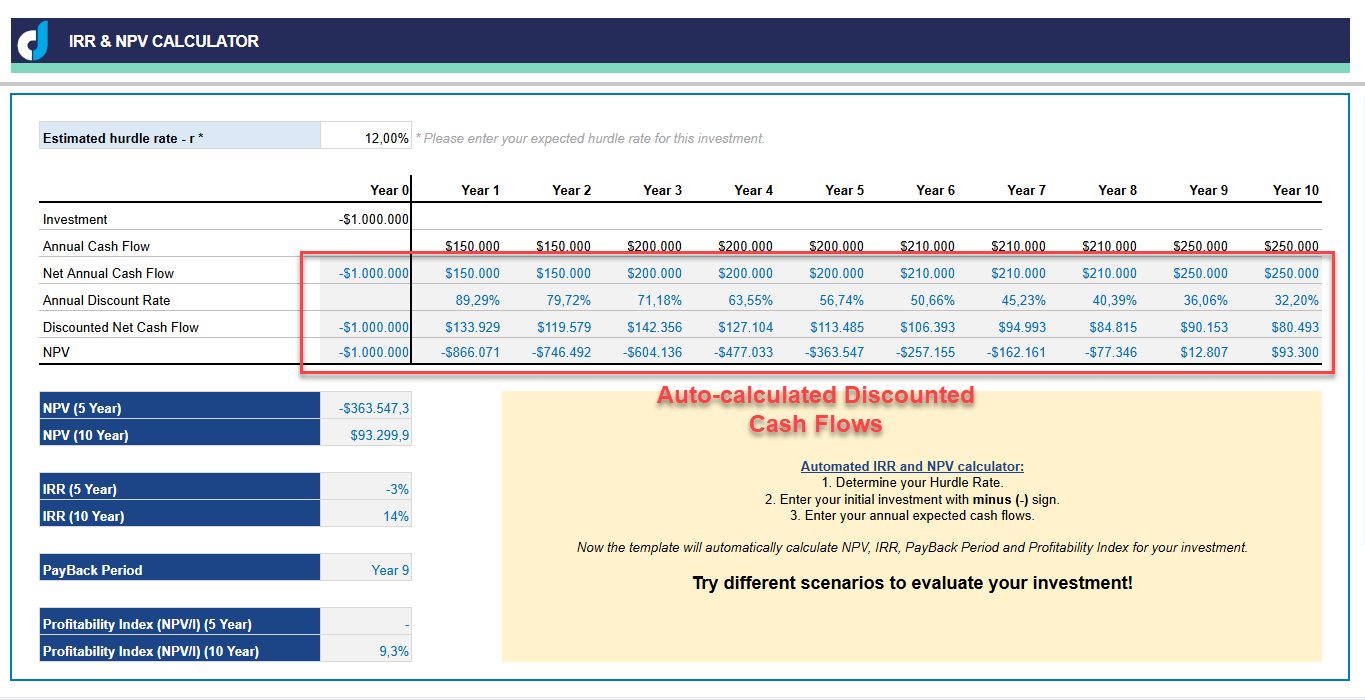

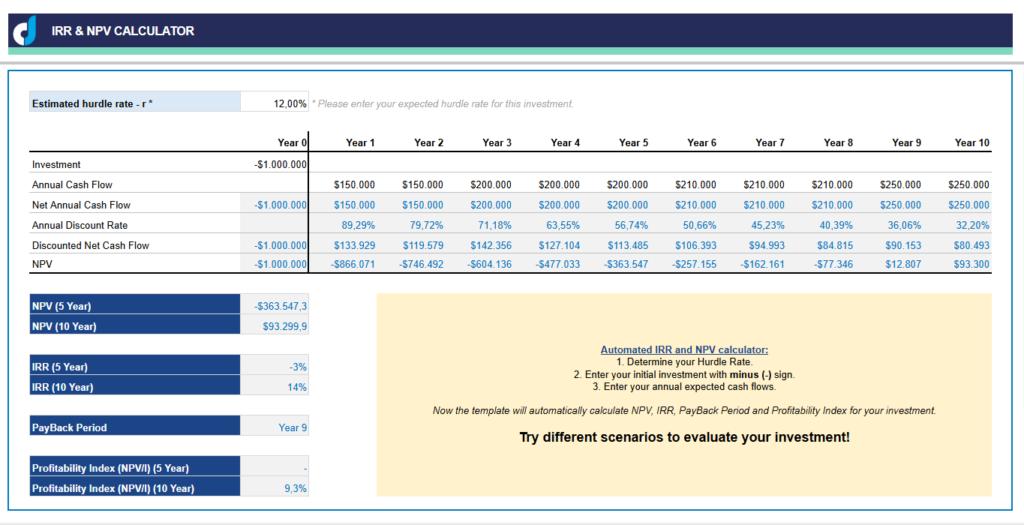

How to use this IRR and NPV Calculator?

It’s extremely easy to use this template:

1. Determine your hurdle rate, which is the discount rate for your future cashflows.

2. Enter your initial investment

3. Write down your expected cashflows for each year.

That’s all!

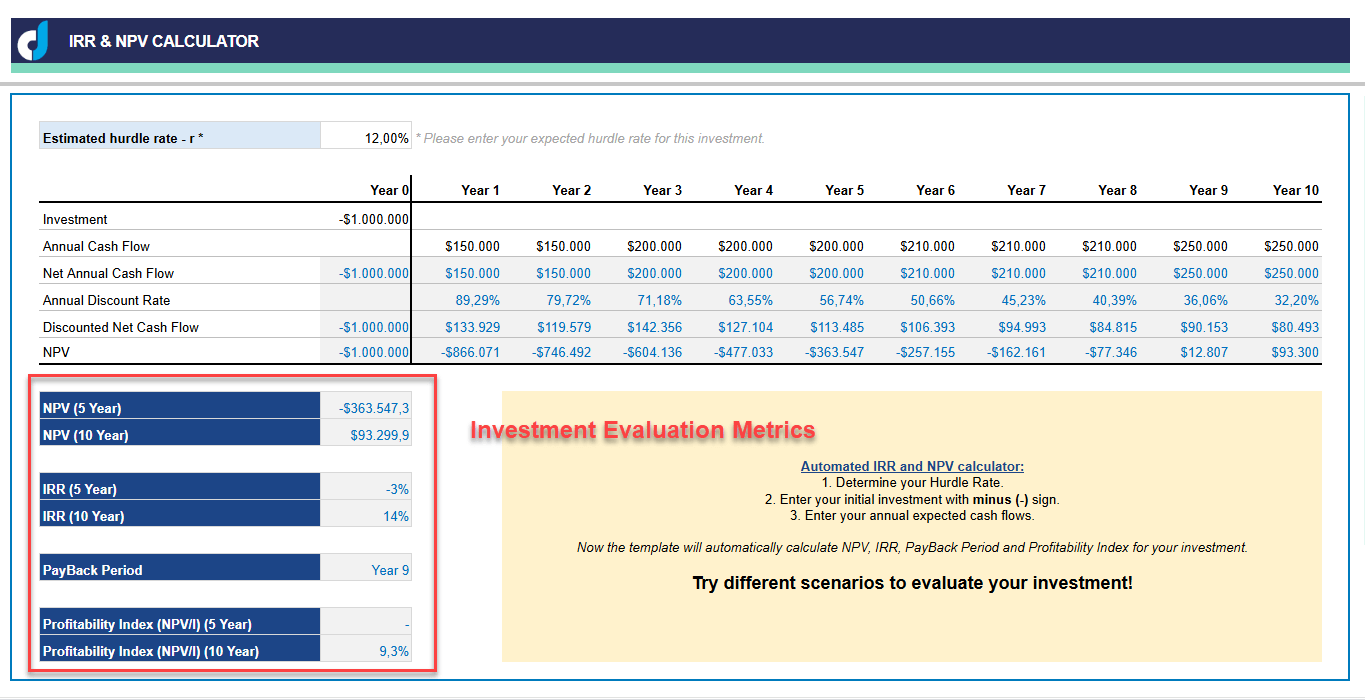

The template will calculate the IRR, NPV and Profitability Index for the five and ten-year periods. Also, the Payback period will be calculated.

Key Features of IRR-NPV Calculator Google Sheets Template

- Complete Investment Analysis: Calculate NPV, IRR, Profitability Index, and Payback Period all in one place

- Flexible Time Horizons: Automatic calculations for both 5-year and 10-year investment periods

- Customizable Hurdle Rate: Set your own hurdle rate to match your specific investment criteria

- Simple Data Entry: Just input your initial investment and expected annual cash flows

- Clear Results: Easy-to-understand outputs with no complex formulas to manage

Perfect For:

- Business owners evaluating capital expenditures

- Real estate investors comparing property opportunities

- Financial analysts preparing investment recommendations

- Entrepreneurs assessing business expansion options

- Portfolio managers screening potential investments

Benefits of Investment Analysis Spreadsheet

- Eliminate Calculation Errors: Avoid costly mistakes with our pre-built formulas

- Save Valuable Time: Get instant results without building complex spreadsheets

- Compare Multiple Scenarios: Easily adjust inputs to evaluate different investment options

- Make Confident Decisions: Base your investment choices on reliable financial metrics

- Standardize Your Analysis: Ensure consistent evaluation criteria across all investments

Easy to Use

Simply enter your hurdle rate, initial investment amount, and projected annual cash flows. The template automatically calculates multiple financial metrics for both 5-year and 10-year horizons, giving you a comprehensive view of the investment’s potential return and risk profile.

Transform your investment analysis process today!

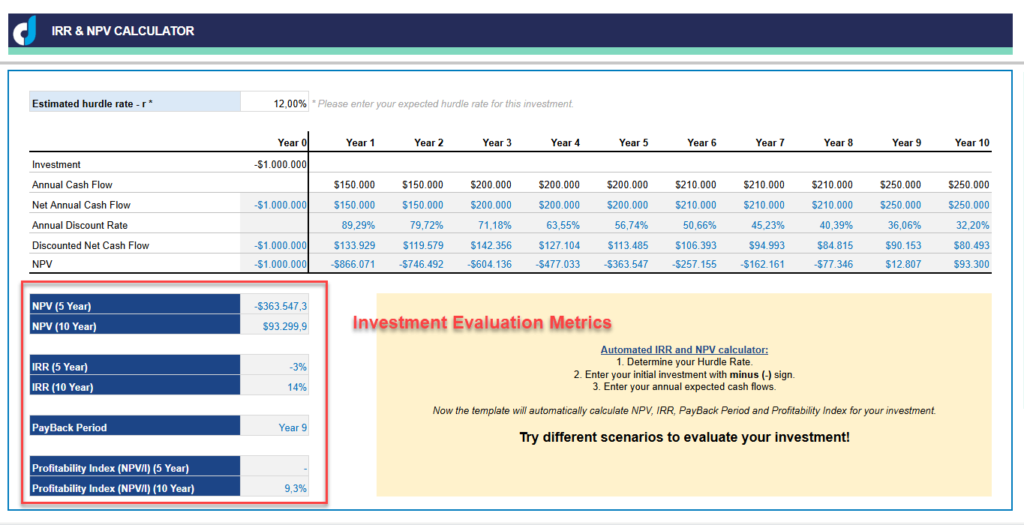

Investment Evaluation Metrics Explained

Here’s an explanation of each investment evaluation metric included in your template:

Net Present Value (NPV)

NPV represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time. It accounts for the time value of money by discounting future cash flows using a specified hurdle rate (discount rate).

Positive NPV: The investment is expected to generate value above your required return rate (hurdle rate)

Negative NPV: The investment is expected to lose value compared to your required return rate

Zero NPV: The investment exactly meets your required return rate

NPV is considered one of the most reliable metrics because it directly accounts for the time value of money and provides a dollar value of the investment’s impact.

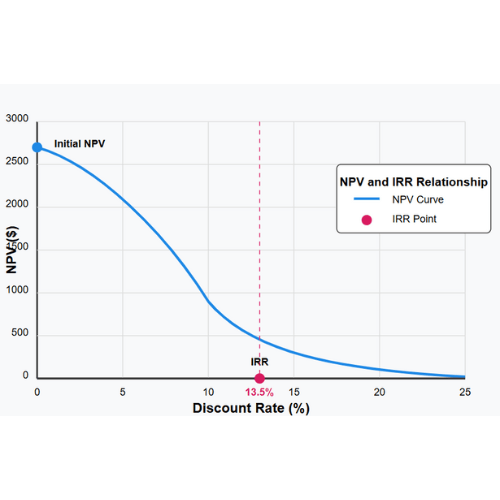

Internal Rate of Return (IRR)

IRR is the discount rate that makes the NPV of all cash flows equal to zero. In simpler terms, it’s the annual growth rate that an investment is expected to generate.

If IRR > Hurdle Rate: The investment is potentially worthwhile

If IRR < Hurdle Rate: The investment may not meet your minimum return requirements

IRR is particularly useful for comparing investments of different sizes since it’s expressed as a percentage rather than a dollar amount.

Profitability Index (PI)

The Profitability Index (also called Benefit-Cost Ratio) is calculated by dividing the present value of future cash flows by the initial investment.

PI > 1: The investment is potentially profitable

PI < 1: The investment is potentially unprofitable

PI = 1: The investment breaks even

PI is especially valuable when comparing multiple investments with different sizes, as it shows the relative benefit per dollar invested.

Payback Period

The Payback Period is the time required to recover the initial investment. It’s expressed in years (or sometimes months) and provides a simple measure of an investment’s liquidity risk.

While the payback period is easy to understand, it has limitations because it doesn’t account for:

- The time value of money

- Cash flows after the payback period

- The magnitude of cash flows

It’s best used alongside the other metrics rather than as a standalone decision tool.

Do you need help for your Excel files?

Let our Experts create custom files for you!

You may be also interested in:

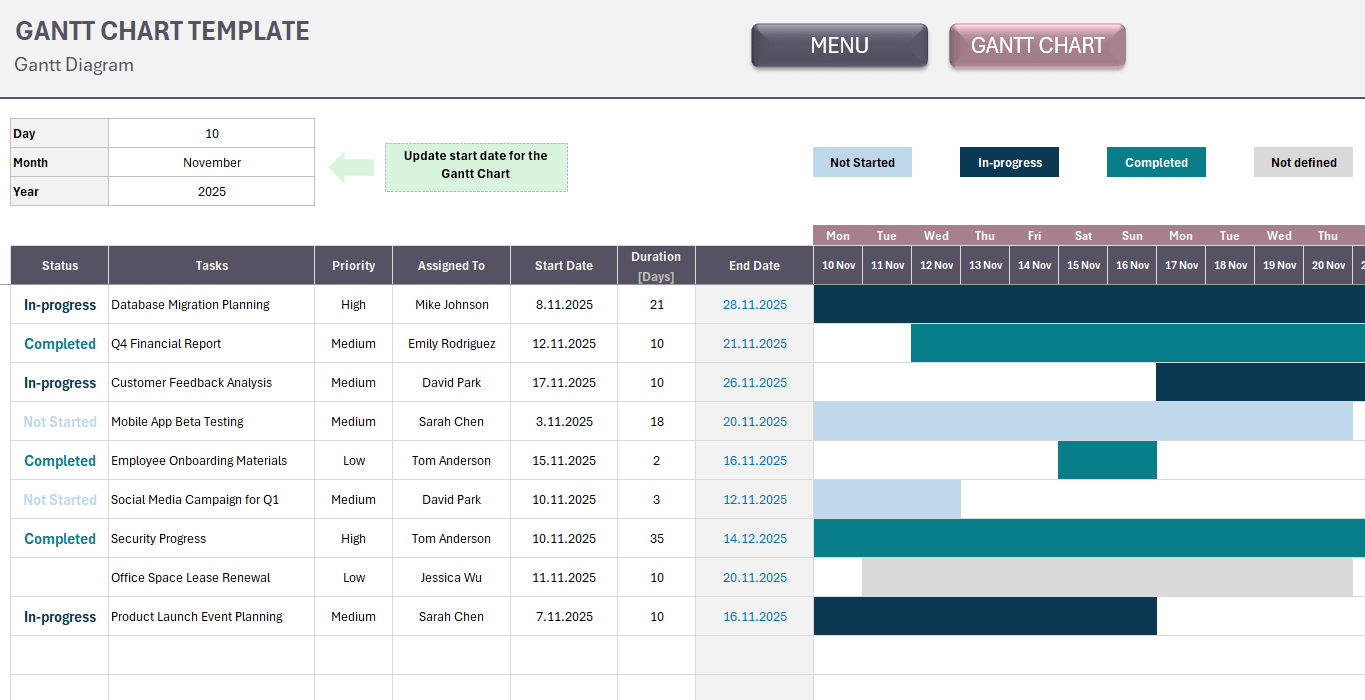

Gantt Chart Excel Template

Gantt Chart Excel Template. Simple task management tool. List your tasks and monitor entire project in a timeline. Editable Excel spreadsheet.

Accounts Payable Google Sheets Template

Accounts Receivable Tracker for Google Sheets. Monitor vendor invoices and payments. No more overdue bills! Ready spreadsheet. Printable account statement.

Accounts Receivable Google Sheets Template

Accounts Receivable Google Sheets Template. Record your invoices and payments, then track cash flow and open balances. Accounts Receivable Tracker. Ready file.

Birthday Tracker Google Sheets Template

Download Birthday Tracker Google Sheets Template. Keep track of all important dates throughout year. Gift planner and anniversary organizer.

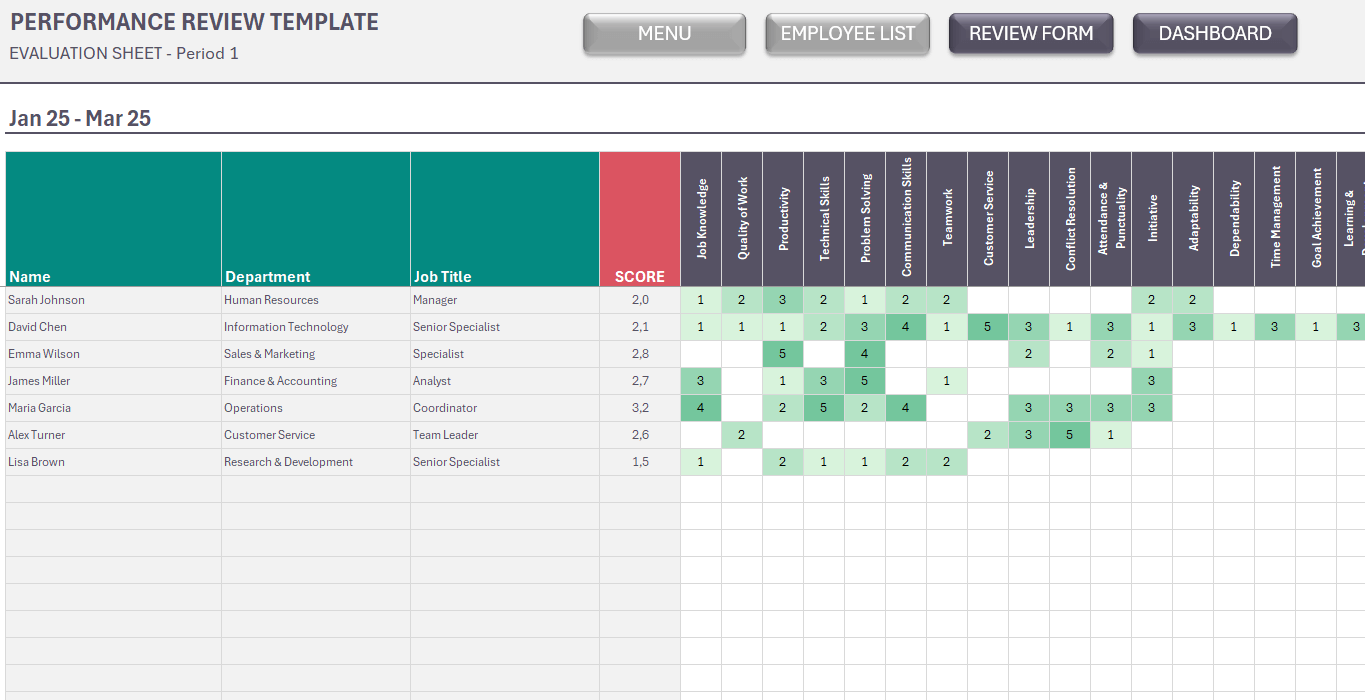

Employee Performance Review Excel Template

Download Employee Performance Review Excel Template. Rate your team members and analyze performance trend. Monthly, Quarterly, Semi-Annualy, or Yearly.

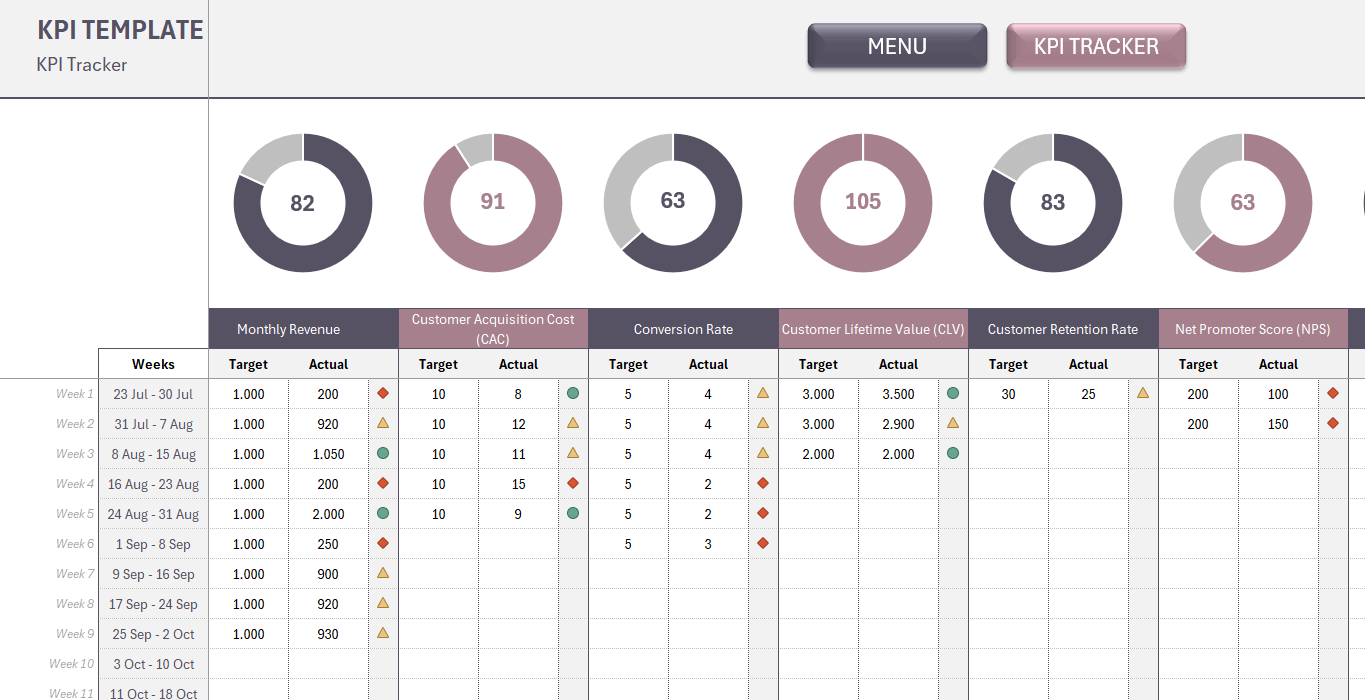

KPI Excel Template

Weekly KPI Tracker Spreadsheet. Instant download Excel file. Compare targets and actual numbers. Sleek-design KPI Dashboard. Download KPI Excel Template.